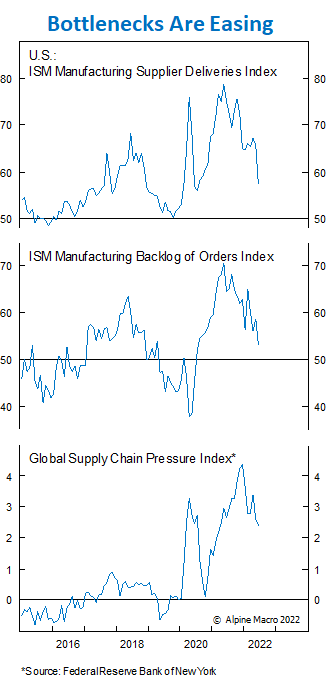

Easing Bottlenecks + Recession = Lower Inflation

The U.S. and global economies are either already in or heading into a recession, supply chain bottlenecks are easing, inventories are building up rapidly, and commodity prices are no longer rising. Are inflation risks tilting to the downside?

Lire l'article

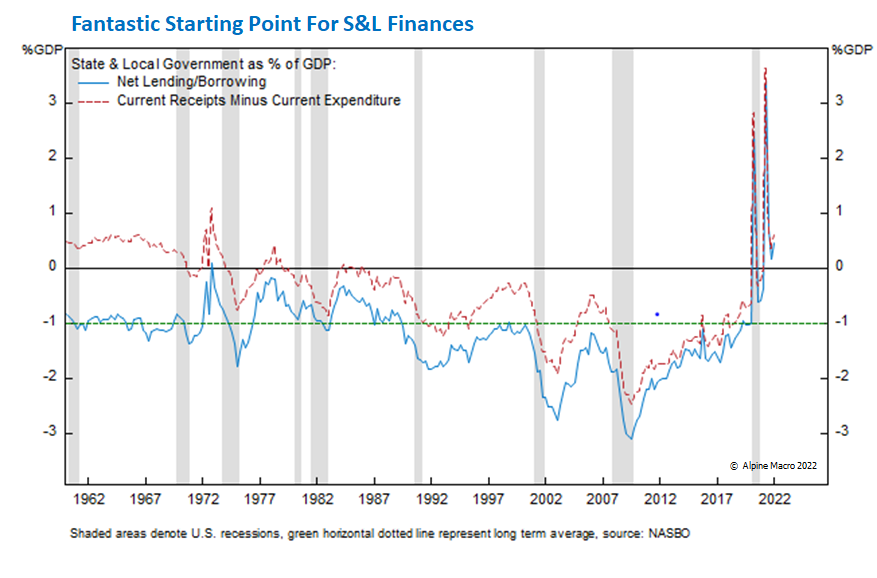

Move Out The Municipals Curve

Today’s report discusses Municipal bond strategy at a time when Treasury yields have peaked but risky spreads have not. The good news is that the starting point for S&L finances is the best it has ever been, providing ample cushion to help weather revenue disappointments. However, this must be weighed against the darkening economic outlook and poor market liquidity. Muni yields and spreads are attractive out the curve, but should total return investors and asset allocators take the duration risk?

Lire l'article

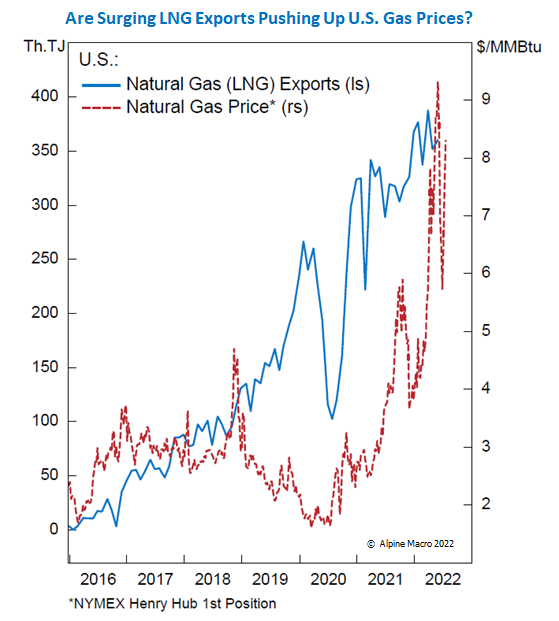

Can The U.S. Solve The European Gas Crisis?

The answer is no. America’s LNG exports have been rising since 2021, while natural gas prices have also soared. Any large increase in LNG exports to Europe will further fuel the surge in natural gas prices, hurting President Biden’s efforts to bring down energy costs and inflation for Americans.

Lire l'article

Dollar Overshoot = Lower Inflation

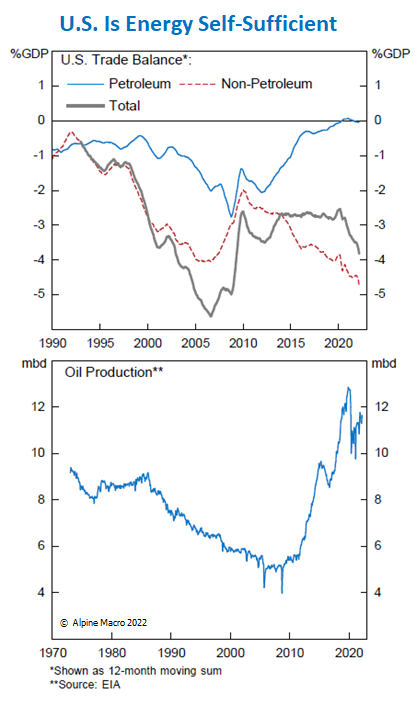

The dollar bull market is not over and may even accelerate. One source of support: the U.S. is energy self-sufficient (Chart). As a result, the surge in oil and the rising risk premium on security of energy supply is better for the U.S. than either Europe or Japan. This increases the odds that speculators will supercharge upward pressure on the greenback until something changes.

Lire l'article

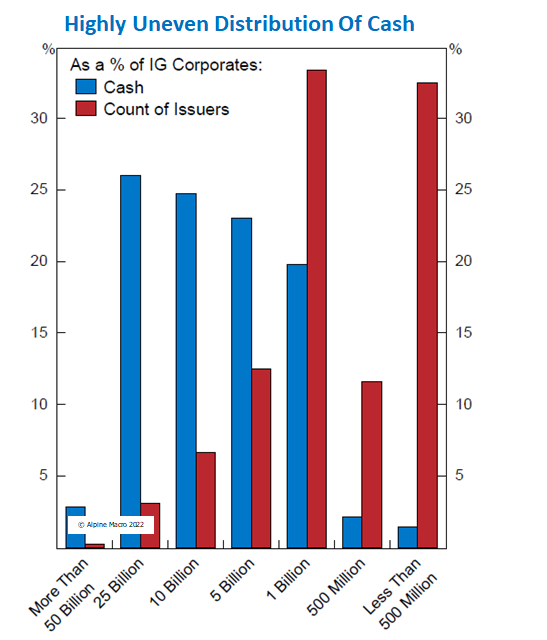

Are U.S. Corporations Really That Healthy?

Some argue that improved corporate balance sheets will allow issuers to weather the coming recession, precluding a major default wave. Are U.S. companies really that healthy?

Lire l'article